What is a Good Credit Score?

Written by

weFiIf your Credit Score is Low, How Can You Improve it?

Your credit score is more than just a number, it’s a key to your financial opportunities. Whether you’re applying for a mortgage, car loan, or even a new credit card, lenders rely on your credit score to assess how likely you are to repay borrowed money. But what exactly is a good credit score, and how can you improve it if you’re not there yet?

Let’s break it down.

What Is a Good Credit Score?

In the U.S., credit scores typically range from 300 to 850. The most widely used scoring model, FICO®, categorizes scores as:

300-579: Poor

580-669: Fair

670-739: Good

740-799: Very Good

800-850: Excellent

👉 According to FICO, the average credit score in the U.S. as of 2024 is 717, placing most Americans in the “Good” category.

Why Does Your Credit Score Matter?

A good credit score can:

Help you qualify for loans, credit cards, and mortgages

Secure lower interest rates and better repayment terms

Strengthen rental applications or utility approvals

Reduce insurance premiums in some states

Influence employment screening in certain industries

👉 Only 22% of Americans have a score of 800 or higher, meaning most still have room for improvement.

What Affects Your Credit Score?

Understanding the five key factors that influence your credit score will help you make better financial decisions:

Payment History (35%): Your record of on-time payments has the biggest impact.

👉 A single 30-day late payment can stay on your report for up to 7 years and cause a significant drop.

Credit Utilization (30%): This is the percentage of your available credit that you’re using.

👉 Try to keep it under 30%, but staying below 10% gives your score the biggest boost.

Length of Credit History (15%): The longer your credit history, the better. If your old cards don’t have fees, it’s smart to keep them open.

Credit Mix (10%): Having a mix of credit types (e.g., credit cards, loans) is beneficial.

New Credit Inquiries (10%): Each hard inquiry can lower your score a bit, so only apply for new credit when you really need to.

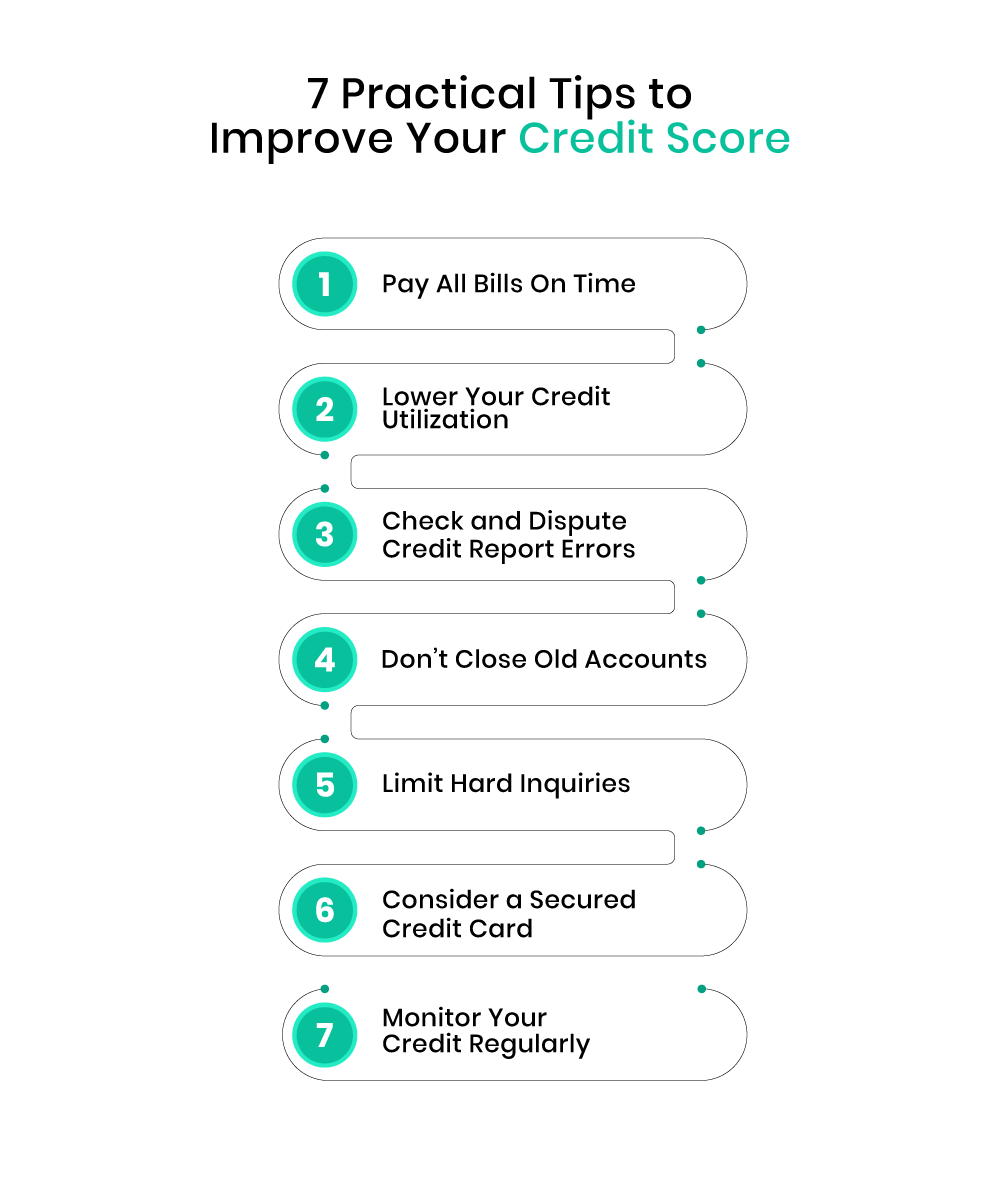

How to Improve Your Credit Score: 7 Practical Tips

1. Pay All Bills On Time

On-time payments are the foundation of good credit. Use reminders or autopay to stay on track, even one late payment can hurt your score.

2. Lower Your Credit Utilization

If you have a $5,000 credit limit, try to keep your balance under $500-$1,500.

3. Check and Dispute Credit Report Errors

Request your free credit report at AnnualCreditReport.com and flag inaccuracies.

4. Don’t Close Old Accounts

Longer credit histories positively affect your score. Keep older cards open if they’re fee-free.

5. Limit Hard Inquiries

Avoid applying for too many new lines of credit in a short time.

6. Consider a Secured Credit Card

Ideal for credit building, a secured card requires a deposit but builds credit just like a traditional one.

7. Monitor Your Credit Regularly

Stay proactive by tracking your score using weFi’s Credit Monitoring Tool.

Building Credit Takes Time - But It’s Worth It

Improving your credit score doesn’t happen overnight, but small, consistent steps pay off. From securing better loan rates to increasing your financial flexibility, a good credit score can unlock many doors.

Start Monitoring Your Credit Today

Knowledge is power especially when it comes to your credit. Whether you're building credit from scratch or working to improve it, weFi’s Credit Score Tracker makes it easy. Track your progress, get real-time alerts, and stay one step ahead of your goals.

Frequently Asked Questions

What is considered a good credit score in the USA?

A good credit score in the USA typically starts at 670. Scores between 740 and 799 are considered very good, and 800+ is excellent based on the FICO® model.

How long does it take to improve a credit score?

Improving your credit score can take 3 to 6 months with consistent habits like paying bills on time, lowering credit card balances, and avoiding new hard inquiries.

What’s the fastest way to increase my credit score?

The fastest way to raise your credit score is by paying down existing credit card balances, or disputing any errors on your credit report, and avoiding new credit applications that cause hard inquiries.

What is a good credit score to buy a house?

There is no universal cutoff, but for most lenders, a credit score of at least 620 is needed to qualify for a home loan. For the best mortgage rates, aim for a score of 740 or higher.

What is a good credit score to get a car?

For most lenders, you can get approved for an auto loan with a score as low as 600, but a score of 670 or above typically gets you better interest rates and more options.

What is a benefit of having a good credit score?

A good credit score helps you qualify for loans, credit cards, and rentals with better terms, lower interest rates, and fewer upfront deposits.

What is a good credit score for a mortgage loan?

For conventional mortgage loans, a score of 620 or higher is usually required. A score above 740 qualifies you for the lowest interest rates and most favorable terms.

What is a good credit score for a college student?

For college students just starting out, a score of 650-700 is considered good. It shows responsible use of beginner credit lines like student cards or secured credit cards.

What is a good credit score to finance a motorcycle?

For most lenders, a credit score of 670 or higher is recommended to finance a motorcycle. Better scores can help you secure lower rates and easier approval.